On November 30th, 2020, the Central Bank of Nigeria introduced fresh guidelines concerning the remittance of foreign currencies into the Nigerian economy. These new measures would allow beneficiaries of diaspora remittances to receive foreign currencies into domiciliary accounts, instead of the Naira.

Prior to this, Nigerian beneficiaries received Naira equivalent of foreign currencies sent.

The additional policies restricted International Money Transfer Operators (IMTOs), from paying remittances in Naira, and Mobile Money Operators (MMOs) was to disable their wallets from receipt of funds from IMTOs. All these simply mean that beneficiaries can only receive US Dollars sent to them if they have USD domiciliary accounts.

Despite CBN’s good intentions of stabilizing the Naira against the Dollar by injecting a fresh supply of the USD into the Nigerian economy through this measure; the fact remains that the rate of foreign remittance into Nigeria would slow down and IMTOs would lose a percentage of potential income.

A major contributor to this slow US Dollar remittance inflow into the country is the fact that not every beneficiary has existing USD domiciliary accounts or the knowledge to create one themselves. In simple words, if a Nigerian beneficiary does not have access to a USD domiciliary account, it becomes difficult for a diaspora remitter to send them funds.

Local banks and IMTOs then have the gigantic task of getting beneficiaries to set-up USD accounts and exercising their discretion to receive Dollars as cash or into their domiciliary accounts. Indeed, that is an enormous task given the size of a Nigerian remittance market expected to exceed $29.8billion in 2021, and the difficult access to accurate information.

A fantastic solution to this problem would be herein needed; one that factors in ease of payment processing by IMTOs, compliance with CBN regulation, and ease of access to remitted US Dollars by beneficiaries here in Nigeria.

The Songhai Exchange Auto Account Creation feature proves to be the game-changing solution needed by IMTOs processing US Dollars to Nigeria at this critical time. Already an established Africa-centric payment Switching platform, Songhai Exchange’s introduction of real-time automatic USD account creation only amplifies the value it brings to the Nigerian remittance ecosystem.

The Auto Account Creation feature allows IMTOs who process US Dollars remittances to Nigeria, using Songhai Exchange technology, to make USD payments using the existing beneficiary Naira Account number.

Songhai Exchange Platform creates this new USD account for the receiver, on request, using their existing Naira account KYC information forwarded by the IMTO or local bank – irrespective of the bank. This amazing solution is possible through Songhai Exchange’s extensive integration with Nigerian banks.

This nationwide banking integration allows all Nigerian banks to offer instant USD account creation service to their customers, and recipients no longer need to go queue at their banks just to open USD domiciliary accounts! Money Transfer Operators who integrate Songhai Exchange have the option to opt-in or out of the Auto Account Creation feature.

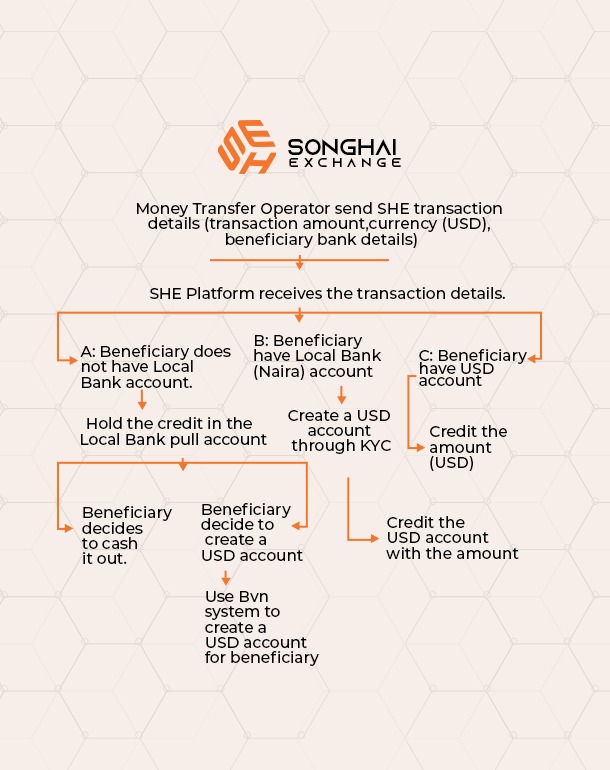

Here’s a graphical illustration of how the auto account creation feature on Songhai Exchange works:

The Payment Redirect functionality is another exciting value-add of the Songhai Exchange Platform Auto Account Creation feature. Payment Redirect allows US Dollars sent to a Naira account to be redirected to a USD account belonging to the recipient.

A remitter needs only forward the Naira account details of a beneficiary to his IMTO. Once the IMTO transmits this request to Songhai Exchange, the Switch performs a call on the local bank of the beneficiary to verify if a USD account already exists for the Naira account details. In the absence of none, Songhai Exchange instantly creates a USD account number for the beneficiary, riding on his Naira account KYC.

The advantageous extents of the Songhai Exchange Auto Account Creation feature are not hard to see. A sentence to wrap it up would be that ‘this automatically allows IMTOs to overcome the US Dollar-to-Nigeria challenge’.

No doubt, the new CBN regulations on US Dollars remittance is a fantastic monetary policy in an effort to liberalize, simplify and improve the receipt and administration of Diaspora remittances into Nigeria. The overall aim of this policy remains to strengthen the naira and the Nigerian economy, which is a welcomed move by the CBN. In the words of the CBN Governor, “we believe that these new policy measures would help in providing a more convenient channel for Nigerians in the Diaspora to remit funds back to Nigeria, as well as ensure that these funds can contribute to the overall development of our economy.”

The Songhai Exchange (SHE) Platform, through the Auto Account Creation feature, is simply designed to foster the aims of this policy. SHE is powered by a strong network of MTOs, banks, billers, payment service providers, and other players within and beyond Africa’s remittance ecosystem.